It is almost the same story, time and again. Most people prefer to trust rather than verify, opening the door to fraud, sometimes fraud on an incredible scale. Just a little competent checking might have prevented monumental disasters.

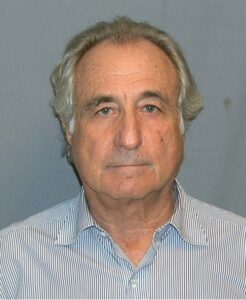

Did anyone note the recent passing of one of the most brazen con men of all time: Bernie Madoff? He died in prison at the age of 82 in April. Accused of running the largest Ponzi scheme of all time and cheating people out of an estimated $65 billion dollars, Madoff was so successful, because he was so trusted. As a prominent member of the Jewish community in New York and as a one-time chairman of the NASDAQ stock exchange, few could conceive that he would cheat them at all, let alone on a massive scale. Although accused of cheating for only about two decades, Madoff was probably involved in fraud for forty years, before being caught in 2008 and sentenced to 150 years in prison in 2009. He was not alone in the fraud, having substantial help from family and friends.

One financial analyst, Harry Markopolis, openly questioned the money that Madoff claimed he was making for investors, saying that it was mathematically impossible. But no one paid attention. Madoff was eventually arrested after his sons confessed to authorities. Following conviction, Madoff told the Securities and Exchange Commission Inspector General that he could have been caught years earlier, but for bumbling investigators acting like “Lt. Columbo.” The auditors never asked the right questions.

Asking the right questions is the first step in securing accountability. Then checking actual data by looking at the company’s books determines whether or not fraud is involved. Giving Madoff a pass for many years, because he looked honest, was outrageous. It encouraged a fraud that victimized thousands. Accountability decades late is hardly sufficient justice. Madoff should have been brought to justice far sooner but he was a friend of powerful Democrat politicians, notably Senate Majority Leader Chuck Schumer of New York.

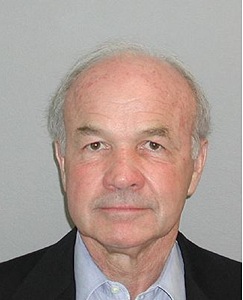

The massive Enron accounting scandal that brought down a huge American energy company in 2001 was also caused by a short-circuiting of accountability. One of the ‘Big Five’ accounting firms, Arthur Andersen LLP was not only dishonest in failing to provide an accurate financial picture of Enron, they were part of the fraudulent schemes of Enron’s management.

Ken Lay founded Enron in 1985 and was its Chairman and Chief Executive Officer. Jeffrey Skilling was Enron’s Chief Operating Officer. Both considered themselves smarter than everyone else in the energy business, especially in manipulating markets to their advantage. Too many saw it to their financial advantage to play along, especially Arthur Andersen LLP.

A company with $100 billion dollars in revenue in 2000 was bankrupt by the end of 2001, costing 20,000 people their jobs, and in many cases, their life savings. Ken Lay was convicted on numerous counts of fraud but died before he could be sentenced. He was a friend of the George H. W. Bush family, and gave millions of dollars to Republicans. Jeffrey Skilling was sentenced to 24 years in prison, served 12, and is now out of prison and reportedly fundraising for another energy trading company. His brother, Tom Skilling, is a popular TV weatherman in Chicago who pushes Global Warming nonsense.

Portland General Electric was owned by Enron and a party to their trading schemes. They escaped Enron’s collapse but are still heavily into building windmills. These are an energy laundering scheme where the electricity from intermittent wind is touted as “green” without pointing out that necessary backup makes the entire system very costly, inefficient, and far from “green.”

Politicians are frequently no better, because they allow businesses to escape scrutiny, as long as they donate to their political campaigns. They also finance a vast array of crony capitalist ventures to serve political purposes and kickback money to their political campaigns. Windmill schemes fall into the later category, because they would never be economically feasible, if not heavily subsidized.

California Governor Newsom is betting that an enormous ‘investment’ of taxpayer money into another crony capitalist scheme will save him from recall. California has a huge homeless population that keeps growing, despite ever increasing amounts of taxpayer dollars allocated to the problem. Newsom’s strategy is much more of the same. He wants voters to approve a massive new bond measure that will provide a large sum that he can distribute to crony capitalists to help the homeless, while kicking back money to his political campaign. If the $75,000 dollars they intend to spend on each homeless person actually went to them, it might begin to address the problem. But it will go to keep Newsom’s supporters well-fed and his campaign war chest full of cash.

Again, Newsom wants no accountability for past failures and offers no standards by which his latest scheme should be judged. Will any homeless person find a place to live? Or will Newsom continue to make it comfortable to live on the streets in sunny California, with his well-paid crony capitalists attending to their needs?

The death of George Floyd from a drug overdose while in police custody in Minneapolis last year caused a spasm of racial violence that Democrats encouraged as a bludgeon against President Trump. Are those blacks whom Democrats view as captive clients, any better off today than they were a year ago? And what about the inner cities that were destroyed and the people killed. Are they better off than they were a year ago. Of course not! No one benefited from the criminal behavior, except Democrat politicians. Their latest foray into racist politics got them elected. Too many voters were fooled into thinking they cared.

We are beginning to see some accountability for the COVID pandemic. Almost everyone is now convinced that the pandemic was caused by release of a human-engineered strain of a SARS virus from a high security laboratory lab in Wuhan, China. Chinese scientists were engaged in “gain-of-function” research, to make the virus more deadly. A year ago, those who said that were characterized as crazy conspiracy nuts, to halt all investigations in the real origin of the virus. Now, we apparently know that three Wuhan laboratory workers became ill with the virus in November 2019, before anyone else. If that is true, it is remarkably strong evidence of the origin.

However, there has been no accountability for Facebook censoring such information for a year, for New York Governor Cuomo sending COVID patients into nursing homes causing thousands of deaths, and for Democrats preventing drugs with proven efficacy from being used against COVID, before the Trump vaccines became available. They could have prevented hundreds of thousands of COVID deaths in this country.

As the pandemic is now waning thanks to very effective vaccines, Democrats are turning back to their very favorite fraud, Global Warming. That utter nonsense has become a $2 trillion dollar per year business that far outstrips anything that Bernie Madoff or Ken Lay imagined. Actually, Lay and Enron were involved in the early stages of the climate fraud, before it became so pervasive and so lucrative.

But Global Warming follows the same pattern as the other frauds: no accountability. You will never hear a Democrat claim that the $100 trillion dollars that Representative Alexandria Ocasio-Cortez wants to spend on her ‘Green New Deal’ will have any verifiable effect on our climate. No cooling, no reduction in hurricanes or tornadoes, or floods, or droughts. And they have no scientific training to claim that anyway. They are only promising to spend our money on whatever they want.

That is what I expect them to do.

It is all fraud.

The greatest con artist of our time, Bernie Madoff, understood this business model perfectly. And he will not care that some of his victims are now dancing on his grave. He had a grand time for decades.

Gordon J. Fulks lives in Corbett and can be reached at gordonfulks@hotmail.com. He holds a doctorate in physics from the University of Chicago’s Laboratory for Astrophysics and Space Research.

No Comments

Leave a comment Cancel